How Donald Trump’s Victory Will Impact Auto Insurance Rates

Last Updated on December 16, 2025

President Donald Trump’s victory in the 2024 election—and his return to the White House in January 2025—has a lot of drivers asking the same question: will auto insurance get cheaper or more expensive?

Here’s the reality: the president doesn’t set your car insurance rate. Auto insurance is regulated primarily at the state level, and insurers still price policies based on risk (your driving record, vehicle, ZIP code, coverage, and claims trends).

But federal policy can influence the inputs insurers use to set premiums—things like inflation, repair costs, medical costs, miles driven, disaster losses, and the overall economy. Below is a practical, non-hype breakdown of the main ways Trump-era policy changes could ripple into auto insurance pricing.

- Bottom line: Presidents don’t control premiums directly—but federal policy can affect the cost of claims, and claim costs drive rates.

- Most of what you pay is “loss costs”: vehicle repairs, total losses, medical bills, lawsuits, and rental cars after crashes.

- Watch these levers: inflation/interest rates, trade policy (parts prices), infrastructure and safety policy (crash frequency), healthcare costs (injury claims), and climate risk (comprehensive claims).

Key Takeaways

- Presidents don’t set car insurance rates directly—auto insurance is regulated at the state level—but federal policy can still influence premiums through inflation, repair costs, and claim trends.

- The biggest drivers of premium changes are claim frequency and severity (repairs, total losses, medical bills, lawsuits, and rental car costs), not politics alone.

- Trade policy, infrastructure investment, healthcare costs, and climate-related disasters can all affect what insurers pay out—so they can indirectly push premiums up or down.

- If your rate rises, your best defense is practical: shop quotes at renewal, adjust deductibles and coverage, and look for discounts like bundling or telematics if you qualify.

- Do Presidents Control Auto Insurance Rates?

- 1. The Economy: Inflation, Interest Rates, and the Cost of Claims

- 2. Interest Rates: Why They Matter to Insurers (and Sometimes to You)

- 3. Deregulation: Potential Cost Savings vs. Consumer Protection Tradeoffs

- 4. Infrastructure Investment: Fewer Crashes Can Mean Lower Long-Run Pressure

- 5. Trade Policy and Tariffs: Vehicle & Parts Costs Feed Directly Into Premiums

- 6. Tax Policy: Indirect Effects on Coverage Choices and Driving Patterns

- 7. Healthcare Costs and Liability: Why Medical Inflation Hits Auto Insurance

- 8. Autonomous Vehicles, ADAS, and Insurance Model Changes

- 9. Environmental and Climate Risk: More Disasters, More Comprehensive Claims

- What Drivers Can Do If Rates Rise

- FAQs on Trump and Auto Insurance Rates

- Final Word

Do Presidents Control Auto Insurance Rates?

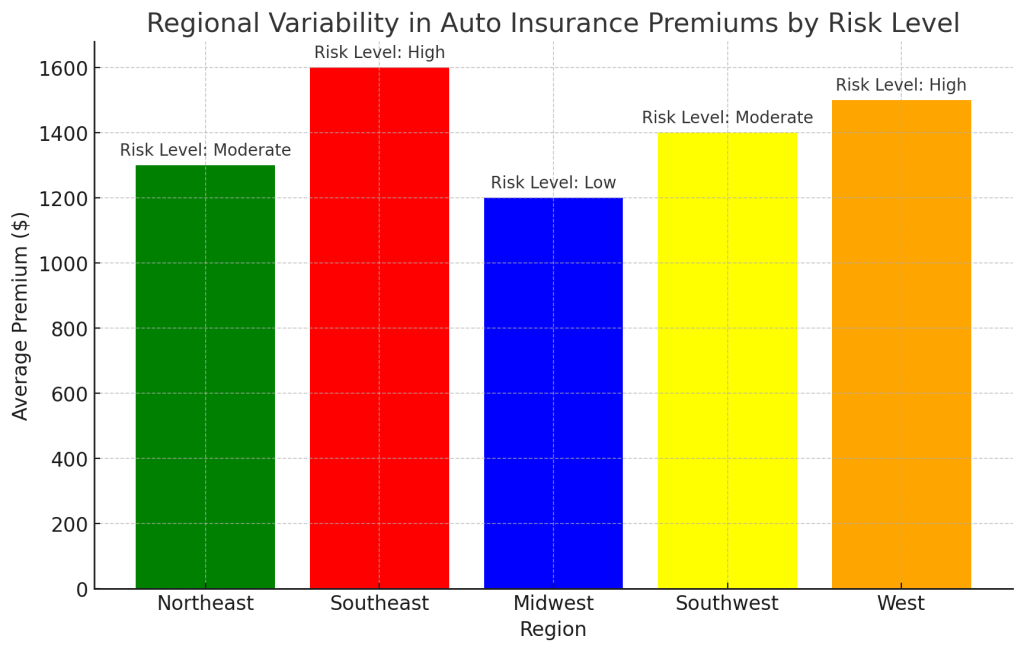

No. Auto insurance is state-regulated, which means state insurance departments approve (or review) how insurers file and apply rates. That’s why pricing can look wildly different from one state to the next—even for the same driver and the same insurer.

What the federal government can influence is the environment insurers price into policies:

- How expensive it is to repair modern vehicles (parts + labor)

- How often crashes happen (miles driven, road conditions, safety tech)

- How expensive injuries and lawsuits are (medical inflation, legal climate)

- How often comprehensive claims happen (storms, flooding, wildfires, hail)

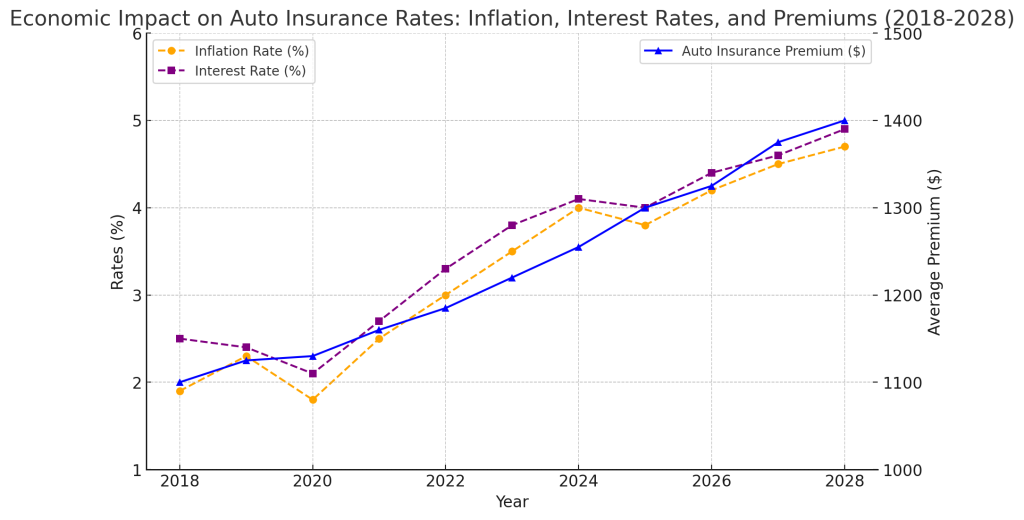

1. The Economy: Inflation, Interest Rates, and the Cost of Claims

Auto insurance rates tend to follow claim costs. When the economy heats up (or inflation stays sticky), the things insurers pay for after a crash often cost more:

- Repair inflation: parts shortages, higher labor rates, longer repair times, and pricier OEM components can push claim severity up.

- Total losses: when vehicle values rise (or repair estimates climb), insurers declare more cars “totaled,” which increases payouts.

- Medical costs: bodily injury and PIP claims rise when healthcare costs rise.

- Rental reimbursement: longer repair cycles can mean more rental days paid by insurers.

If Trump pursues aggressive pro-growth policies—tax changes, deregulation, and other measures intended to stimulate business activity—drivers could see both upsides and downsides. More jobs and higher wages can be positive for households, but inflationary pressure can raise the cost of claims, which insurers often pass back into premiums over time.

If you want a neutral benchmark for how “auto insurance inflation” is behaving nationally, the Bureau of Labor Statistics tracks a CPI category specifically for motor vehicle insurance here: Motor vehicle insurance CPI factsheet.

2. Interest Rates: Why They Matter to Insurers (and Sometimes to You)

Insurers don’t just collect premiums—they also invest those premiums (mostly in conservative, fixed-income assets). That means interest rate shifts can affect insurers’ financials, which can influence pricing decisions.

Higher rates can increase investment yields over time, but they can also create short-term volatility in bond portfolios and don’t automatically offset rising claim severity. In practice, the relationship is messy: rates may help insurers on one side of the balance sheet while repair/medical inflation hurts the other.

One easy reference point for rate trends is the Federal Reserve’s federal funds rate series (via FRED): Effective federal funds rate (monthly).

3. Deregulation: Potential Cost Savings vs. Consumer Protection Tradeoffs

Deregulation is often a hallmark of Trump-style economic policy. In theory, less red tape can reduce insurer administrative costs. But whether that lowers your premium depends on competition, state regulation, and claim trends.

Also, keep expectations realistic: most meaningful auto insurance rules are set by states. Even if the federal government changes its regulatory posture, state insurance departments still determine how rates are filed, what rating factors are allowed, and how consumer disputes are handled.

- Possible “good” outcome: insurers reduce some costs and compete harder on price.

- Possible “bad” outcome: more pricing variability, more aggressive underwriting, and more friction in claims—especially for higher-risk drivers.

4. Infrastructure Investment: Fewer Crashes Can Mean Lower Long-Run Pressure

Road quality and traffic design matter. Better road surfaces, safer intersections, improved lighting, and modernized signage can reduce crash frequency. When claims frequency drops, insurers have less pressure to raise rates.

That said, infrastructure impacts typically take time. Even with funding and projects moving quickly, the insurance benefits tend to show up gradually (think: years, not weeks).

5. Trade Policy and Tariffs: Vehicle & Parts Costs Feed Directly Into Premiums

Trade policy matters to auto insurance because it can change how expensive it is to fix cars. When parts prices rise—especially for imported components—repair estimates rise. When repair estimates rise, claims costs rise. And when claims costs rise, premiums tend to follow.

- If tariffs increase the cost of parts: insurers may see higher average repair severity.

- If supply chains tighten: repair times can get longer, pushing rental reimbursement higher too.

- EV and advanced tech vehicles: sensors, cameras, specialized body materials, and OEM-only parts can amplify repair inflation even without tariffs.

6. Tax Policy: Indirect Effects on Coverage Choices and Driving Patterns

Tax cuts don’t directly change how insurers price risk. But they can influence:

- Household budgets: some drivers may upgrade coverage (lower deductibles, add comp/collision) when they feel financially stronger.

- Vehicle purchasing: stronger consumer spending can mean more new car sales, and newer cars can be more expensive to insure and repair.

- Miles driven: economic growth can increase commuting and delivery traffic, which can increase crash frequency.

7. Healthcare Costs and Liability: Why Medical Inflation Hits Auto Insurance

Auto insurers pay a large amount of medical-related costs through bodily injury claims and (in many states) personal injury protection (PIP). When medical costs rise, claim severity often rises too.

This effect can be especially noticeable in no-fault insurance states, where PIP is a required or common part of coverage and medical billing can significantly affect premiums.

8. Autonomous Vehicles, ADAS, and Insurance Model Changes

Even before full self-driving becomes mainstream, modern driver-assistance features (automatic emergency braking, lane-keep assist, adaptive cruise control) and vehicle tech can change both crash frequency and repair severity.

- Fewer crashes (potentially): better safety tech can reduce certain collision types.

- More expensive repairs (often): calibration, sensors, and specialized parts can raise repair severity after even minor accidents.

- Liability questions: as automation increases, fault may shift more toward manufacturers and software—changing how future insurance products are structured.

For a deeper look at how pricing can change with automation, see: how much do self-driving cars cost to insure?

9. Environmental and Climate Risk: More Disasters, More Comprehensive Claims

Climate and catastrophe losses show up in auto insurance most clearly through comprehensive coverage—hail, floods, hurricanes, wildfires, and falling debris.

Regardless of any administration’s environmental approach, insurers price for expected losses. If weather-related claims rise in frequency or severity in a region, premiums (or comprehensive deductibles) can rise too—especially in higher-risk ZIP codes.

- Does auto insurance pay for damage from natural disasters?

- Does auto insurance cover hurricane damage?

- Will car insurance pay for flood damage?

- Will auto insurance cover fire damage?

What Drivers Can Do If Rates Rise

No matter who’s in office, the best way to protect your wallet is to control the factors you can control. If your premium jumps at renewal, these steps often help:

- Shop your policy at every renewal (especially after a rate increase).

- Re-check deductibles (raising comp/collision deductibles can reduce premium, but only do it if you can afford the out-of-pocket).

- Drop coverage you don’t need (for older cars, collision may not be cost-effective).

- Ask about telematics / usage-based discounts if you’re a low-mileage, safe driver.

- Bundle auto + home/renters if the combined discount beats separate policies.

- Review your vehicle choice before buying (some trims are far more expensive to repair and insure).

FAQs on Trump and Auto Insurance Rates

Final Word

Trump’s second term can influence auto insurance rates, but mostly indirectly—through the economy, repair and medical costs, trade policy, road and safety investment, and climate-related losses.

If you’re trying to predict your next renewal, focus less on headlines and more on the fundamentals: claim costs in your state, your personal risk profile, your vehicle’s repairability, and whether you’re consistently shopping your coverage. That’s where most real savings happen.

Leave a Reply